This add-on is available with the purchase of the Pro license.

The Tax Reports add-on can help you with the U.S. tax reporting requirements for payments made to affiliates.

You'll be able to send a reminder email to affiliates who have earned more than $600 in the tax year, but do not have an address or tax ID set in their profile, to encourage them to update their information. You can also download a CSV file with a list of every affiliate who has earned $600 or more and resident in the United States, with their address, how much they earned and their tax ID, so that you have all of the information you need to fill out 1099 forms.

First, you'll need to install this add-on from the Easy Affiliate > Add-ons page.

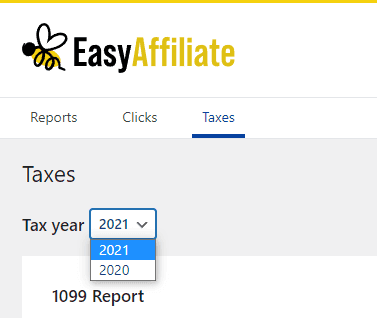

Once installed, head to Easy Affiliate > Reports page, then go to the Taxes tab.

At the top, you can select which tax year to view. You'll want to select the year before the filing deadline. For example, for filing deadline January 31, 2022, select tax year 2021. By default, the previous year will be selected automatically.

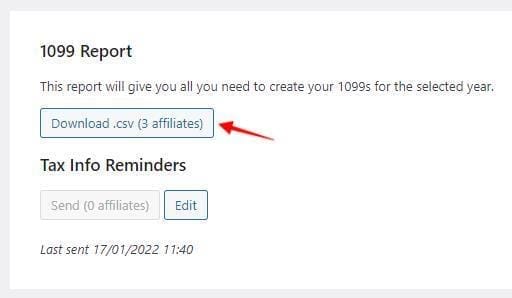

Next, check to see if you have any affiliates with incomplete tax information, they may be missing their address or tax ID in their account settings. You can see if any affiliates match this criteria by looking at the button in the “Tax Info Reminders” section. If the button reads “Send (0 affiliates)” and is disabled, completed tax information exists for all eligible affiliates. If the button reads, for example, “Send (3 affiliates)” and it's blue, it means that 3 affiliates have incomplete tax information.

Click the “Send (3 affiliates)” button to send these 3 affiliates a reminder email. The email will contain a link to the Account page of the Affiliate Dashboard where they can update their information. You can view or edit the email content by clicking the “Edit” button. A reminder email can also be sent to a specific affiliate by hovering over them within the table and clicking “Send Reminder”.

You may need to wait some time for affiliates to update this information within their account settings. For this reason, we recommend that the reminder emails are sent well in advance of the deadline.

Note that only affiliates with no address set or those with an address in the United States will appear within the table. If an affiliate updates their information and they set an address with a country other than the United States, they will no longer show up.

The final step is to download the CSV containing the information necessary to complete a 1099 form for each affiliate.

Click the “Download .csv” button to initiate the download. You'll then have everything you need for your 1099 forms!